But wait, it gets worse. The number for India is very badly out of date; this for example suggests "only" $8B in 2017. And if I then poke around, I find that the global total for 2017 is "only" $300B.

So, isn't this just a bit shit? How come that of the proudly-touted list of 3200 Belgische wetenschappers en academici, not one of them could be bothered to source their statements properly or check the numbers?

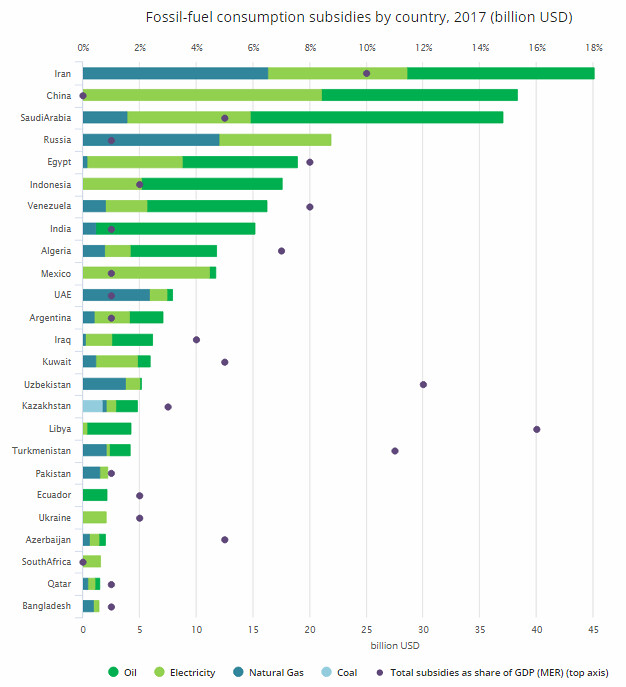

Anyway, here's a fuller pic, from the IEA. As you'll see, and as you'd probably expect, it's a pile of tin-pot energy-banana-republics.

Which of course points you to the solution: it's nothing to do with GW, or subsidies specifically; it's "better governance".

Refs

* Imaginary $500B not enough for you? Why not go for $5T instead?

* How to decarbonize? More free market!

* Schumpeterian Profits in the American Economy: Theory and Measurement by William D. Nordhaus; NBER Working Paper No. 10433

* The marten menace: What’s cute, furry and can disable a particle accelerator?

* Corruption is still rife around the world - Economist

* Analysis: Why the UK’s CO2 emissions have fallen 38% since 1990 - Zeke Hausfather

* Mr. Flood's Party - TF

* The Mighty Difference Between Immigration and Trade - by Bryan Caplan

* NOW IS THE TIME FOR ALL GOOD PRONOUNS TO COME TO THE AID OF THEIR COUNTRY

* Henderson on AOC and Allowing Billionaires

* The Mighty Difference Between Immigration and Trade - by Bryan Caplan

* NOW IS THE TIME FOR ALL GOOD PRONOUNS TO COME TO THE AID OF THEIR COUNTRY

* Henderson on AOC and Allowing Billionaires

* A rose by any other name by Scott Sumner

* Ben Zycher on Subsidies to Fossil Fuels by David Henderson

* Ted Gayer on Subsidies to Fossil Fuels [2023/05]

Conservatives are unlikely to accept a carbon tax.

ReplyDeletehttps://www.nationalreview.com/2019/02/carbon-tax-proposals-three-major-problems/

Sometimes it is hard to tell the difference between a tragedy and a farce.

I'm presuming you realise that none of the arguments in your ref need be taken seriously; the point - I assume - was to indicate that they're putting up arguments against it. Meh. A background noise of such stuff is just to be expected.

ReplyDeleteIs that because your mailbox wasn't full of glossy election flyers making these exact points?

ReplyDeleteNoise? Perhaps. But noise can work, politically.

A more serious objection is that it is mostly too early for carbon taxes. The alternatives to carbon fuels are less than 10% of the energy economy, so a subsidy is 1/10 to 1/100 the cost of a tax, or less, for the same effect.

Suppose there are 10 ideal econ-man on an island. There is a new idea that will improve life for everyone, but will take time to implement, and the first user will pay more or get less for some limited amount of time. Why would any agree take up the new idea? It is against their personal interest, it would be better if someone else did it first. So they might rationally agree to tax those that do not take up the idea at a cost to 9 people, or to subsidize the 1 person that implements the new idea. The net of the tax is a 9 times larger distortion than the subsidy in the otherwise ideal economy of the island. So being rational, all of the 10 will vote for a subsidy.

This is the same discussion that we've had before, though of course I can't find it now. You - and I - not having any entrepreneurial spirit fail to understand said spirit. People constantly throw themselves at risky ventures in the hope of making out big. Indeed, the dead weight of bureaucracy / socialism is one of the reasons free-market capitalism does so well, despite it's inefficiencies.

ReplyDeleteThe idea that it is too early for a carbon tax is, I think, simply wrong. There are any number of economic decisions being made now that would be made better with such a tax.

I'm curious about the thoughts on the following estimate of $20 billion in US subsidies for fossil fuels - do these meet your definition of "direct"? http://priceofoil.org/content/uploads/2017/10/OCI_US-Fossil-Fuel-Subs-2015-16_Final_Oct2017.pdf

ReplyDeleteI'll also note for your IEA chart, it is specifically "consumption" subsidies, and very much NOT a "fuller pic". They calculate it by taking the price consumers pay and comparing that to the price they would pay for fuel imported from the international market. So that's why western economies don't show up on that list: even if barrels of money were being air-dropped on fossil fuel companies, as long as the actual sale of the fossil fuels is determined by market forces, this particular IEA analysis would estimate zero dollars of consumption subsidies. https://www.iea.org/weo/energysubsidies/

-MMM

ps. I do agree that there are many people out there who are pretty loose about their definitions, and I'd like to see more rigorous analysis: I have to say, even though Oil Change International is an advocacy org, their analysis seemed to me to be a reasonable accounting method.

Note that on this island of economic perfection, the costs and benefits of future actions is known in advance, and all details about profit and loss are already known. So "entrepreneurial spirit" doesn't change anything. Note that you are appealing to irrational behavior on an island of ideal rationalism. The first mover pays a price, the rest gain. So to get a first mover, the rest must in some way either provide an economic reward for being first (a subsidy) or a punishment for not being first (a tax).

ReplyDelete"The idea that it is too early for a carbon tax is, I think, simply wrong. There are any number of economic decisions being made now that would be made better with such a tax."

Yes, there are decisions that would be made better with a tax. That doesn't address the issue of it being too early for a tax to be optimal. Subsidies are more efficient than taxes when only a small fraction can/will take the less-polluting alternatives. See the Island.

> http://priceofoil.org/content/uploads/2017/10/OCI_US-Fossil-Fuel-Subs-2015-16_Final_Oct2017.pdf

ReplyDeleteFrom the what-is-a-subsidy section: "Broadly speaking, a fossil fuel subsidy is any government action that lowers the cost of production...". But there's a problem: imagine the govt funding a US university and that university researches, I dunno, more efficient bearings that end up being of general benefit to the world, but which also have the effect of making nodding donkeys work more efficiently. That, according to this report, is a subsidy to production.

So you have two choices: either you (a) accept that this is so, in which case you are forced to conclude that "subsidy to production" is not in itself a bad thing; that many good things can be so described. Or, (b) you conclude that their definition is too broad.

Since we also read "Removing these highly inefficient subsidies..." and yet we've just noticed that increasing efficiency would also count as a subsidy, I think we're forced to go with option (b): their defn is too broad.

I think all the substance is in appendix 1, which I think they've ripped off from someone else, because I think I've seen it before.

And very quickly it degenerates into technicalities. Take item 1, "Deduction for Intangible Drilling Costs". WTF is that? https://www.crfb.org/blogs/tax-break-down-intangible-drilling-costs looks like a reasonable source. And... well, it doesn't seem to be unreasonable.

> a tax to be optimal

Ideas about tax optimality are great to prop up arguments with but aren't much use in practice, I think.

"dead weight of ... socialism"

ReplyDeleteSomehow this dead weight builds and maintains almost all the roads in the world. This dead weight built and now maintains the majority of the hydropower dams and all the irrigation infrastructure here in the US west. Not to mention flood control on the Mississippi River and elsewhere by the Army Corps of Engineers.

"Ideas about tax optimality are great to prop up arguments with but aren't much use in practice, I think."

ReplyDeleteSo much for economics. If you don't care about economics, perhaps you might care about minimizing government.

I'm interested in economics. I care about economics, in a practical sense, as I file a Schedule C. You are a wage slave, correct? But I'll follow your interest so we can continue to discuss this.

So let us start over with minimizing government as the only goal. Carbon taxes, subsidies for alternatives and carbon release ownership are three ways of accounting for the externality of CO2 releases.

All have strong points, all have weak points. Shades of grey.

The lowest long term government involvement might be a carbon market, enforced by legal actions of the carbon rights owners. Make the owners legally responsible for the harm of their releases, so that they will try to minimize claims from fishermen because the oceans don't support as many fish, seashore property owners, farmers and tropical people that can't live there because it got too hot.

Before peak carbon, subsidies are likely lower government involvement than taxes. After peak carbon, taxes are likely lower government involvement.

A very very tiny government can pay out yearly (or some other period) prizes for technology improvements like LED bulbs. One time subsidies.

Prize/GNP = $10 million/$19.39 trillion is very small fraction.

A slightly larger government can subsidize things like nuclear energy, solar cells and electric cars up to the point of significant market share. Energy is about 10% of the economy, put a limit of 0.1% total subsidy, and solar cells would have a high subsidy when volumes were tiny (think 20 years ago), and the percentage subsidy would decline as production continues to explode. If solar cells were 100% of energy, then the subsidy would be roughly 1% of install cost, and few would notice when it was discontinued.

Carbon taxes, if set to match the potential harm, are at least the size of energy costs. This requires a government that handles roughly 10% or more of the economy. Well past peak carbon, a tax that collects some tiny fraction of the economy as a carbon tax will provide both a tax rate that rises with time, and eventually no revenue as there is nothing left to tax. Or cap at the fair Pigovian tax level, but that's economics.

Regulations can vary from huge government involvement to fairly tiny, depend on details. Weights, measures and such are both vital and very cheap.

Thank you for the link (https://www.crfb.org/blogs/tax-break-down-intangible-drilling-costs). I do find weird tax issues to be confusing. But, while the tax treatment "may not be unreasonable", if it is treating fossil fuel extraction differently from other industries, leading to lower costs, then I think that's grounds to call it "special treatment". There are plenty of market mechanisms available to raise funds for risky ventures with long-term payoffs - the government should only intervene in cases with clear societal benefits.

ReplyDeleteWhich leads me to your discussion of the more general statement that, "a fossil fuel subsidy is any government action that lowers the cost of production". I think that is a fair definition of a subsidy. Some subsidies can be justified because there are positive externalities - that is the point of government funding basic science and universities, or subsidizing zero-carbon electricity, or electric cars, or the like (I will note that I generally prefer taxing bads over subsidizing not-bads: I'm about to write a response to Phil Hays about his island example). But I think the report is only looking at fairly direct links - I don't see concepts like subsidizing ball bearing research aren't popping up in Appendix 1, but rather the appendix is focused on moneys specifically set aside (or taxes not levied) to support activities that are for the most part specific to the fossil fuel extraction activity. And given that if anything, fossil fuel extraction and use has negative externalities, I don't see a good justification for government coming in to smooth the way for these activities.

Clearly all the weird deductions listed in Appendix I must have some value to the fossil fuel industry, or they wouldn't have been created. And they are a cost to the government, in terms of taxes that would have been raised. Whether elimination of these subsidies would actually lead to the government raising the dollar values listed - probably not, because in a market economy, there would be at least some reduction in activity resulting from eliminating the subsidies, so there wouldn't be a full recouping of that money, but even at a 50% discount that's on the order of 10 billion. Which isn't peanuts.

Phil Hays: on your island example: there are times when subsidies are a good idea. Researching something which will improve life for everyone is an example. But when there are negative externalities from one activity (say, getting coconuts by chopping down trees), and what you want is to persuade people to move towards an activity without that negative externality, a tax is a much cleaner instrument. Because with the subsidy, you have to pick the new zero-externality activity beforehand (say, throwing rocks at coconuts to knock them down). With a tax, you let the islanders decide how to address the issue: maybe they prefer chopping down trees to rock throwing, even with the tax. Or maybe the one of the econ-men finds a new solution that is better than the first solution, like a long stick. Or maybe they decide that the coconuts were an unnecessary luxury in the first place. Putting on a tax lets the market figure out how to respond.

ReplyDelete-MMM

"Putting on a tax lets the market figure out how to respond", as does a subsidy. Both "internalize the externality".

ReplyDeleteThe dividing line isn't harm vs benefit, but rather time and proportion.

If everyone can switch to a lower harm method tomorrow, then a tax is a cleaner way of addressing an externality.

If there is a significant delay, where not everyone could switch at once even if they wanted to, then a subsidy would be cleaner at the start, and a tax would be cleaner after that.

If we just want one person or any other small fraction of people to switch to the new method, then a subsidy is cleaner. Perhaps we just need one person to not cut down coconut trees to ripen then spread coconuts to make new trees so others can continue to cut down the trees to get the nuts.

In the real world, energy supply transitions take many decades. Solar is over 1% of electric power, but still well below 1% of total energy. Growing rapidly, but even best case will not top 50% before 2050.

Phil Hays wrote >"A more serious objection is that it is mostly too early for carbon taxes. The alternatives to carbon fuels are less than 10% of the energy economy, so a subsidy is 1/10 to 1/100 the cost of a tax, or less, for the same effect."

ReplyDeleteHow do you justify these numbers? A subsidy uses government money so it has to be raised from other taxes and those taxes have distorting effects on the tax paying proportion of the population.

Compared to this, the tax on bad activities has distorting effects but these are the distorting effects you want to solve the problem and this raises tax money which can be used to reduce other taxes and their distorting effects.

So if you think distorting effects of taxes are the main cost/adverse effect then taxing bad activities looks to be better than subsidy even before problem of considering which approach to subsidise?

Of course, in reality the situation is more complicated: there are costs in collecting taxes which can vary from tax to tax, higher/lower rate of the tax may not make much difference to the total collection costs so extra taxes are likely to increase total collection costs, and there are also costs in setting up new taxes.

I am probably missing some effects. Feel free to add them.

Anyway AFAICS, before getting to relative cost, you need to consider:

1. Whether new tax is cheap or expensive to collect and set up.

2. Whether there are lots of alternative approaches and whether this can be better left to market to decide or if govt providing more money to ultimately best policy avoids getting stuck with inferior policy that is 'quicker to market'.

3. Whether it is just a small fraction of people to switch to start with.

and probably more.

.

>"Solar is over 1% of electric power, but still well below 1% of total energy. Growing rapidly, but even best case will not top 50% before 2050."

Well if we could get to solar 30%, wind 30%, nuclear 20%, biomass 20%, then .... does solar staying at only 30% mean it should always be subsidy? This means government choosing this solution and if market might find better source or size of this source, wouldn't it be better for the market to decide?

So I can't say I believe <50% means subsidy is better. At <1% you may have a strong argument but even that, I suggest, might be outweighed by other considerations.

Aside from being a sort of slogan thrown around as 'self evident', how does this actually make any sense?

ReplyDelete"Indeed, the dead weight of bureaucracy / socialism is one of the reasons free-market capitalism does so well, despite it's inefficiencies."

One of the reasons free-market capitalism does well is the dead weight of B and S?

It's REALLY an odd statement...

With the exception of biofuels, nuclear and hydro we are at less than 1% of total energy from renewable sources. Of these, only nuclear could grow significantly, and there are reasons to suspect that nuclear will not grow rapidly anytime soon. Biofuels are in competition with human food and the rest of the ecosystem. If anything, we should be trying to reduce usage of biofuels. Hydro is site limited, and most of the good sites are in use.

ReplyDeleteWind energy has a climate change problem. Taking energy out of the winds changes the climate. Sure, if you take a little, not an issue. Taking enough to power civilization would be a serous issue. Ten times more is probably not a big problem, one hundred times more probably is.

All this basically leaves solar and/or nuclear as most of the sustainable future energy. With fusion as a wild card. There are not lots of alternatives!

I agree that the situation is different near or above 50%. I'm focusing on the current situation. The alternative we can realistically grow are at <1%.

"A subsidy uses government money so it has to be raised from other taxes and those taxes have distorting effects on the tax paying proportion of the population."

Of course. However other taxes can be designed for less bad side impacts relative to the amount of taxes collected. A tax on carbon (or anything, bad or not) is going to have other side effects as well, and some of those are undesirable side effects. For example, carbon taxes are a larger fraction of income of people less able to pay taxes because they have less income.

A key difference is 100 times more money needs to be collected with a carbon tax, than spent with a carbon alternative subsidy, when the carbon alternatives are mostly less than 1% of the energy market. Other than the ones that should get smaller, biofuels, can't grow as there are no more sites for hydro, and nuclear is unlikely to grow quickly, if at all.

A carbon tax hits past decisions as well as future decisions.

Consider anything with capital investment: equipment that lasts for years. Power plants, cars, ships, aircraft.

The average lifetime of a car in the USA is over 20 years. So the first year of carbon taxes mostly is just a tax: behavior can't change much. People must own mostly the same cars they owned last year. Still drive about the same, need to go to work and such... These thing don't change for even a fairly large price change. Price doesn't change demand for gasoline significantly in time intervals of a year.

So we tax 100% of the people to motivate the 5% of the people that will be buying a car to buy a more fuel efficient or perhaps an electric car, which could be almost zero carbon.

Jet aircraft last about 25 years. Power plants last about 40 years.

Add to this time the design cycle time, the manufacturing set up time, the manufacturing equipment cycle: to change this stuff takes decades at best.

There is one way a carbon tax could be more effective than a subsidy at 1% of alternatives. Put a carbon tax in place that takes effect in 30 years or perhaps more. Why is this more effective? It make the future price of carbon higher, leading to changes in the designs now, changes in the installed base over the next few decades, so when it comes time to collect the tax, there is far less to collect. If we could do this in a believable way, that is.

Which leads me to go off topic, make this a joke. Ocasio-Cortez: "in 10 years, we're trying to go carbon-neutral." Not a whisper of a reality in that vision.

Unless maybe what you're saying is something like the 'Dead weight' of Public Education (or the NHS) is one of the reasons that free-markets succeed... Coz that's sounds right to me.

ReplyDeleteThat being said, there is really no free market. They're all constrained somehow. National boundaries being one constraint, that's a huge impediment to the free movement of labour.

> minimizing government

ReplyDeleteGood idea.

> A very very tiny government can pay out yearly (or some other period) prizes

Doesn't resemble reality; this kinda of "subsidy" is too small to be of interest.

> A slightly larger government can subsidize things like nuclear energy, solar cells and electric cars up to the point of significant market share

Whaaaat? You've jumped from something paying out millions to billions, and calling that only "slightly" larger? No, this is where your error comes in; you're using words to paper over the cracks.

> Carbon taxes, if set to match the potential harm, are at least the size of energy costs

Not believable I think; I've seen no credible suggestions of this scale.

Also, you're confusing size of govt with amount of money passing through govt. All things being equal it's a reasonable zero-order estimate, but not in the case of carbon taxes.

> tax on bad activities

Nice point CR.

>> >"Solar is over 1% of electric power, but still well below 1% of total energy. Growing rapidly, but even best case will not top 50% before 2050."

People regularly underestimate the growth of solar.

> if it is treating fossil fuel extraction differently from other industries, leading to lower costs, then I think that's grounds to call it "special treatment"

Indeed, but is it? There's no evidence presented for that. And as we all know, the US tax code is stuffed full of exemptions for this and that; most other industries will undoubtedly have something similar. So, to come back to the first thing, "Deduction for Intangible Drilling Cost", I couldn't really tell from looking at it whether it was a boondoggle or simply a perfectly reasonable thing to do. Can you? If you can't, that suggests that at the least it isn't grossly unreasonable.

> all the weird deductions listed in Appendix I

They look weird to you - and to me - because we don't understand them. But you shouldn't - per my previous para - pass from looks-weird-to-me to must-be-a-boondoggle. Otherwise you're like the Watties, who pass from these-GCMs-look-complicated-I-don't-understand-them to they-must-be-wrong.

> free-market capitalism does well is the dead weight of B and S?

FMC does well by comparison with...

> there is really no free market

In the same sense in which balls of different weight really do fall at different speeds.

Phil Hays wrote "A tax on carbon (or anything, bad or not) is going to have other side effects as well, and some of those are undesirable side effects. For example, carbon taxes are a larger fraction of income of people less able to pay taxes because they have less income."

ReplyDeleteI agree there are undesirable side effects.

If we concentrate on tax collection costs, we would tend to go with a single tax and a high rate. This minimises the collection costs but it has horrible distorting effects because of the high rate.

By having lots of taxes, this allows lower rates, widens the tax base and the distorting effects of each tax is reduced by it being at a lower rate. Also distorting effects of one tax can to some extent offset the distorting effects of other taxes. So this minimises distorting effects but comes at a cost of higher collection costs.

So the optimum is to have some balance between too many and too few different taxes.

So if we have too few taxes, adding a different tax aimed at bad activities where the main distortion is an effect you want might be a really good idea. However, if we have too many taxes (or at optimum level) then extra tax is only likely to be a good idea if it is tackling a major problem.

.

Biofuels are tiny and compete for agricultural land so unlikely to grow hugely and if you think they should shrink you may have a valid point. By biomass, I am talking about burning waste food, farm waste, wood coppicing ? etc. I agree wood pellets where trees are cut down to produce them are a bad idea, somehow restricting to waste wood seems more sensible.

.

>"A carbon tax hits past decisions ... Consider anything with capital investment: equipment that lasts for years"

Yes true. However there are lots of future uncertainties in making an investment and regulatory environment is just one of these that should be assessed. I don't think we should feel too sorry for wiping out past investments if it is the right thing to do. Investor should have considered possibility and decided to invest anyway.

.

>"Wind energy has a climate change problem. .. Taking enough to power civilization would be a serous issue."

Does it? Ref please.

> Ref please.

ReplyDeleteI'm pretty sure David MacKay covers that point.

Is that David MacKay meant to be a link? Skimmed relevant looking chapters of http://www.withouthotair.com/cft.pdf

ReplyDeletewithout finding climate change problem of too much wind. Perhaps wind as 30% of total power does look to be more than just challenging but this seems space related rather than effect on climate related. That seemed the focus anyway.

Perhaps I missed it or perhaps a different ref or perhaps I should have included "Taking energy out of the winds changes the climate" in the quote?

(I accept that it does have some effects on the climate (e.g. more air mixing presumably), but does this matter significantly?

>> People regularly underestimate the growth of solar.

ReplyDeleteReference doesn't show the fraction of solar vs total energy consumed. REFERENCE FAILURE!

PV Solar energy 256 TWh 2016

https://data.bloomberglp.com/professional/sites/24/2017/09/BNEF-Summit-London-2017-Michael-Liebreich-State-of-the-Industry.pdf

Total primary energy 160,000 TWR 2016 (IEA_HeadlineEnergyData)

And you might find this handy, as different units keep being used in different sources.

https://www.iea.org/statistics/resources/unitconverter/

I'm sure solar has grown since then. But not by that much. More recent statistics are either less than trustworthy or behind paywalls. Solar has historically grown by about factor of 10 about every 8 years. World passed 0.1% in 2014 or so. World might pass 1% in 2022 or so, not that far in the future... At the same rate, we might pass 10% in 2030, and then slow to adding about 2% to market share per year. We might pass 50% in 2050. Assuming subsidies continue for a least a few more years, and the storage problem can be addressed. And yes, all goes well, which isn't likely. Yes, solar subsidies should be phased out in a decade or less, perhaps before the 10% market share point. Solar + storage is often not always cheaper than coal for the production of electric power, and will soon if not today, be cheaper than natural gas. Costs very regionally. And yes, the breakpoint between exponential growth and linear growth could be earlier or later. The IEA keeps thinking that the breakpoint is today. And they keep being wrong.

IEA says

"The increasing competitiveness of solar PV pushes its installed capacity beyond that

of wind before 2025, past hydropower around 2030 and past coal before 2040. The

majority of this is utility-scale, although investment in distributed solar PV by households

and businesses plays a strong supporting role."

Which is likely pessimistic. But not as pessimistic as in the past.

https://webstore.iea.org/world-energy-outlook-2018

Solar needs storage to get past a fraction (perhaps as much as 20%) of energy produced. Batteries are getting good enough and cheap enough to handle the daily cycle and perhaps the weekly cycle, but the seasonal cycle will require something else.

Thermal solar, using solar heat directly, is not included, and might already be beyond 1%. However, hard to define and estimate, and unlikely to grow much.

Hydro, wind, geothermal, tidal, and biomass are all not capable to supplying enough energy for our current economy on a sustained basis.

I stuffed up my href. The point I was looking for was something like

ReplyDeleteLet’s be realistic. What fraction of the country can we really imagine covering with windmills? Maybe 10%? Then we conclude: if we covered the windiest 10% of the country with windmills (delivering 2 W/m2), we would be able to generate 20 kWh/d per person, which is half of the power used by driving an average fossil-fuel car 50 km per day.

There just isn't enough land for wind.

Wind and climate change

ReplyDeletehttps://www.cell.com/joule/fulltext/S2542-4351(18)30446-X

Wind isn't as bad as fossil power.

>> A very very tiny government can pay out yearly (or some other period) prizes

ReplyDelete>Doesn't resemble reality; this kinda of "subsidy" is too small to be of interest.

LED bulbs.

Self driving cars.

>>> A very very tiny government can pay out yearly (or some other period) prizes

ReplyDelete>>Doesn't resemble reality; this kinda of "subsidy" is too small to be of interest.

> Self driving cars.

Now you're well off the rails. Self driving cars are absorbing zillions of zlotys of private entrepreneurial money - you remember, all that money that private enterprise would never pony up because it is too risky. Perhaps that's why you can't see it.

>LED bulbs.

ReplyDeleteyes, small things can have a small place.

>Self driving cars.

Huh? Cheaper transport means more demand and self driving means not only vehicle miles demanded but also additional mileage driving to next customer. There is saving through fewer cars manufactured and more sharing, maybe that is dominant factor, but are we sure?

Electric cars being more efficient and less reliant on ff as grid changes away from ff. This seems important rather than LED bulb being a bit player.

So unclear as to meaning intended of putting 'Self driving cars' after LED bulbs.

.

Coming back to 'time' for subsidy vs time for tax. If renewables are now cheaper than ff, then it seems to me the time for subsidies has past. Continuing to subsidise might help speed transition but it seems to be pouring money to add to return on investment that should already be sufficient. That seems a serious distortion and speed up effect unclear.

ReplyDelete>> Carbon taxes, if set to match the potential harm, are at least the size of energy costs

> Not believable I think; I've seen no credible suggestions of this scale.

"The International Energy Agency (IEA) recommends that the price of one ton of CO2 be gradually raised by 2040 to $140 for developed countries"

http://carbon-price.com/wp-content/uploads/Global-Carbon-Pricing-June-2017.pdf

https://www.bloomberg.com/news/articles/2018-10-10/how-much-does-carbon-need-to-cost-somewhere-from-20-to-27-000

And $140 is probably lower than needed. You can, of course, find much higher and much lower values. Like Trump's EPA at a laughable $2 per tonne of CO2. Or Exxon's $20 per tonne of CO2. How to generate a low value? Easy. Limit the area of damages considered, perhaps to one country, set a high discount rate, limit the time considered which the high discount rate helps on as well.

The price of a ton of coal was about ~$39/ton delivered to a power plant last year. Or about $101 per tonne of CO2.

Oil was priced at about $50 a barrel recently. A barrel contains about 0.43 tonnes of CO2. About $116 per tonne of CO2.

>Also, you're confusing size of govt with amount of money passing through govt. All things being equal it's a reasonable zero-order estimate, but not in the case of carbon taxes.

Why would it be not the case for carbon taxes?

PH>>>> A very very tiny government can pay out yearly (or some other period) prizes

ReplyDeleteWC>>>Doesn't resemble reality; this kinda of "subsidy" is too small to be of interest.

PH>>Self driving cars.

CR>Huh?

https://en.wikipedia.org/wiki/DARPA_Grand_Challenge

>Cheaper transport means more demand and self driving means not only vehicle miles demanded but also additional mileage driving to next customer. There is saving through fewer cars manufactured and more sharing, maybe that is dominant factor, but are we sure?

ReplyDeleteThis is a reasonable point, I'm not sure what the net climate impact from self driving vehicles actually is. Some have claimed large improvements, mostly on the goods delivery side. However my point was that technology changes can be generated by prizes that are tiny fractions of GNP.

>Electric cars being more efficient and less reliant on ff as grid changes away from ff. This seems important rather than LED bulb being a bit player.

https://www.bbc.com/news/science-environment-46741346

> Coming back to 'time' for subsidy vs time for tax. If renewables are now cheaper than ff, then it seems to me the time for subsidies has past. Continuing to subsidise might help speed transition but it seems to be pouring money to add to return on investment that should already be sufficient. That seems a serious distortion and speed up effect unclear.

Then we should have stop subsidizing solar cells in 1956. After all, they were cheaper power than all the alternatives for satellites. Solar is cheaper some places, at some times of day/year. Saying "renewables are now cheaper than ff" is a logical statement. The actual issues is a fuzzy problem. When is it enough true, rather than when is it binary true.

Yet you have a point: subsidies need to have an end, and ending subsidies for solar power wouldn't have the drastic impact on the future if done today that it would have 20 years ago. "When to end" is a fuzzy topic. I think we agree that ending before another decade is enough. Today might be true, and might not. 20 years ago wasn't true.

> Now you're well off the rails. Self driving cars are absorbing zillions of zlotys of private entrepreneurial money - you remember, all that money that private enterprise would never pony up because it is too risky. Perhaps that's why you can't see it.

ReplyDeleteToday, yes. 2004?

https://en.wikipedia.org/wiki/DARPA_Grand_Challenge

> Deduction for Intangible Drilling Costs

ReplyDeleteBy chance, I run across https://www.volts.wtf/p/subsidies-really-do-matter-to-the in which David Roberts (for it is he) talks about IDC. He notes that (a) IDC is actually the dominant subsidy; and (b) "The oil and gas industry receives the same treatment that other manufacturing or extractive industries receive".

DR's reply is the predictable dirigiste non-liberal "but we want to encourage manuf, so that subsidy there is good; but exactly the same subsidy for FF is bad". This replacement of general rules with rules tailored to whim is, of course, bad. There is far too much of it already; we need less, not more.

Rules need to be tailored to needs, not whims.

ReplyDeleteWe need oil (and other fossil fuels) to die a slow death. Not too fast, as replacement technologies are not ready yet. Not too slow, as the climate is warming.